Fascination About Group Health Insurance - Insurance Glossary Definition

3 Simple Techniques For What's the difference: individual vs group health insurance?

To get more information about your alternatives for economical small company medical insurance strategies, go to or talk with one our licensed insurance agents. This short article is for general details and might not be updated after publication. Consult your own tax, accounting, or legal advisor rather of relying on this article as tax, accounting, or legal advice.

Top 18 Group Health Insurance Advantages & Disadvantages - WiseStep

Group Medical Insurance Strategies in Springfield, MO For more than 65 years, Nixon & Lindstrom has been helping small company owners and midsize business throughout Springfield and southwest Missouri protected affordable group health insurance protection for their employees. As knowledgeable brokers, we deal with leading insurance coverage carriers like Anthem Blue, Cross Blue, Shield, United Healthcare, Cox Health, Plans, Humana and Aetna to construct customized group health strategies.

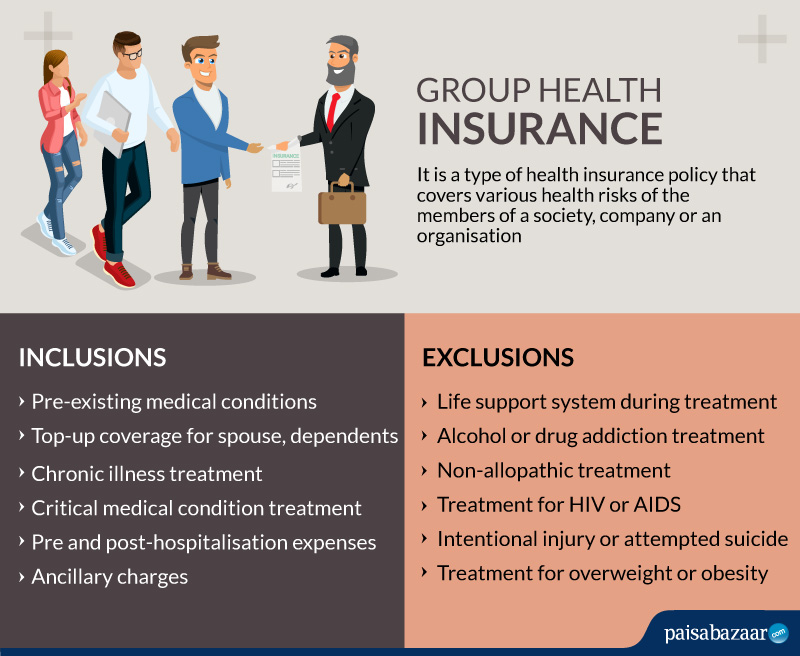

Request a quote today to get started. A group medical insurance strategy is a mechanism for companies to supply company-sponsored medical protection to workers. Through these plans, the company and worker typically divided the cost of health insurance coverage premiums. By spreading out the expense throughout the group, more staff members have access to cost effective healthcare through a designated provider network.

What benefits are included in a small group health insurance plan?

Not known Incorrect Statements About Group Health Insurance Plans for Small Businesses - Canal HR

Registration in a group health insurance plan is not obligatory for staff members, however a particular portion of members should participate to set off the group advantages. Group medical insurance strategies are as different as the workers who enlist in them. Many strategies, nevertheless, fall into 4 significant categories. Here's a rundown of the various sort of strategies and their specifying characteristics.

Health Care Organization (HMO) Among the more common types of group health insurance, HMOs have a specific network of doctor with agreed-upon copays and deductibles. Employees enrolled in an HMO should pick a medical care doctor (PCP), but they usually enjoy lower premiums and out-of-pocket costs. Workers should remain in network to receive coverage and get a referral from their PCP to see a specialist.

What Is A Group Health Plan And What Should You Include?

Like HMOs, these strategies have a healthcare service provider network, and employees who remain in network pay lower negotiated rates. However, in a PPO, employees do not have to choose a PCP, and they can see out-of-network service providers without paying full price. A Good Read (EPO) EPOs share numerous similarities with HMOs but normally provide lower rates than both HMOs and PPOs.